5 Steps to Deduct Office Decorations on TurboTax

When setting up or revamping your office space, the thought of decorating often comes to mind. Not only does an aesthetically pleasing office environment enhance productivity, but it can also offer tax benefits if done correctly. Utilizing TurboTax to claim deductions for office decorations can seem daunting, but with the right approach, it can be straightforward. Here, we'll walk through the five essential steps to effectively deduct office decorations using TurboTax.

Understanding Office Decoration Deductions

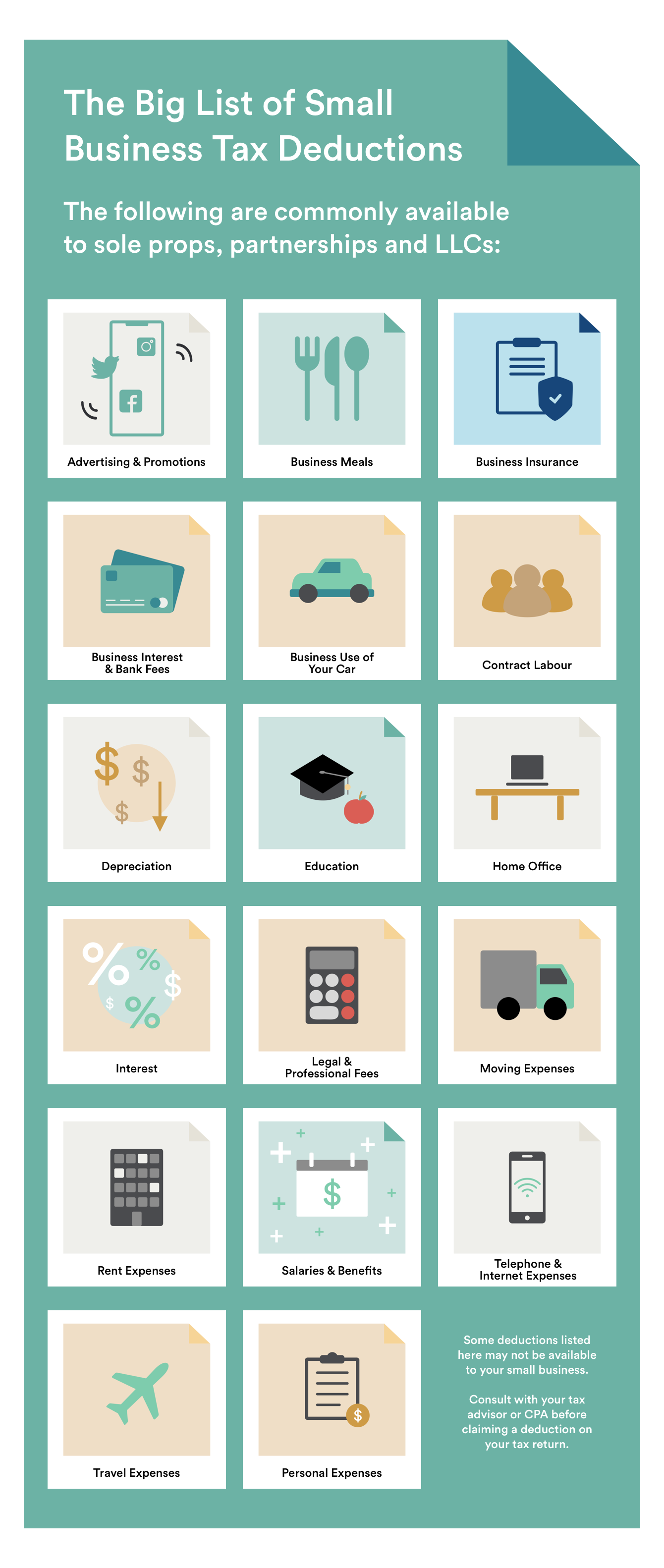

Before diving into the specifics of how to claim these deductions, it’s important to understand what qualifies as a deductible office decoration. Typically, any item that improves the functionality, aesthetics, or comfort of your office can potentially be claimed.

- Furniture like desks, chairs, and shelving units.

- Decorative items such as paintings, plants, or lighting that enhance the office environment.

- Office supplies used primarily in your office space.

Step 1: Identify Deductible Expenses

Start by identifying which items in your office can be considered for deductions. Here are some key points:

- Functionality: If the item directly improves your work efficiency or the functionality of your office, it can likely be claimed.

- Exclusive Use: The decoration must be used solely for your office and not for personal use.

- Capital vs. Expendable: Understand whether the item is considered a capital expense (like furniture, which depreciates over time) or an expendable one (like office supplies, which are immediately deductible).

📝 Note: Keep receipts for all purchases. TurboTax requires documentation for these deductions.

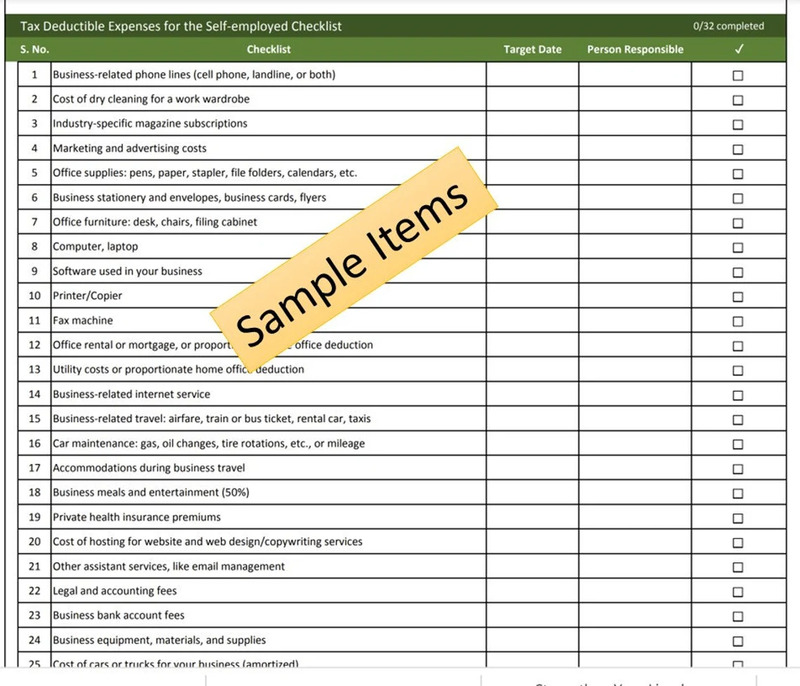

Step 2: Gather Necessary Documentation

Having the right documentation in place is crucial:

- Receipts: Keep original receipts for all your purchases, detailing the date, item purchased, and cost.

- Photos: Before and after photos can visually demonstrate how the decorations enhance your office environment.

- Bank Statements**: Credit card or bank statements showing transactions related to these purchases can also serve as proof.

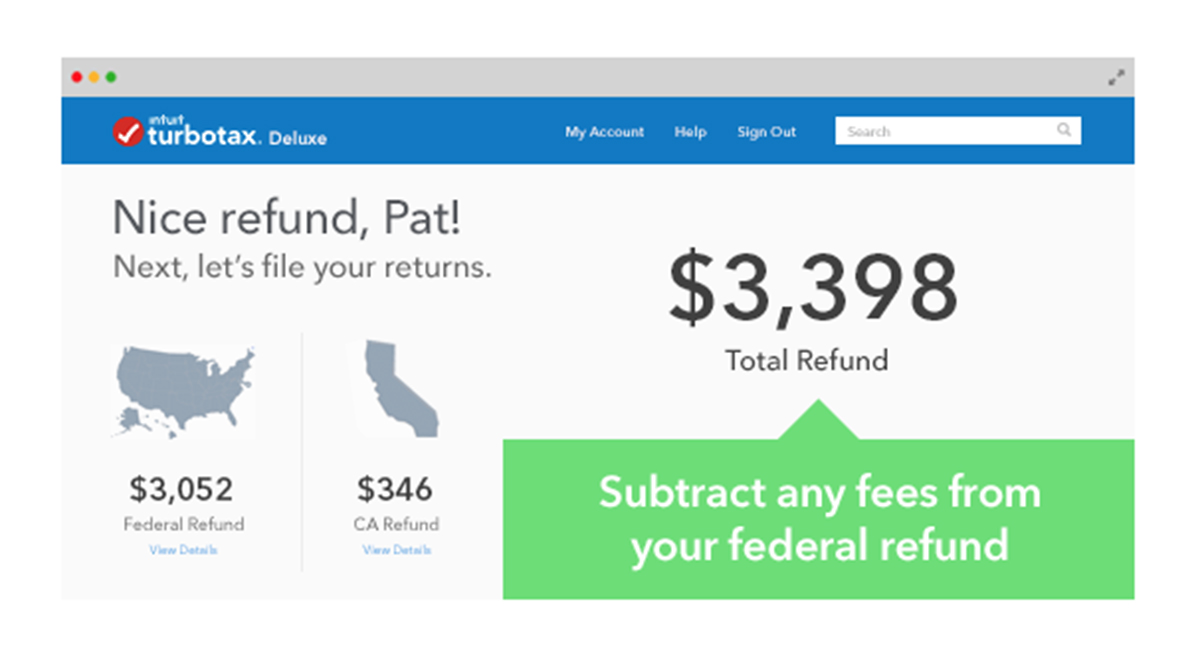

Step 3: Use TurboTax to Categorize Your Deductions

Within TurboTax, you need to correctly categorize your deductions. Here’s how:

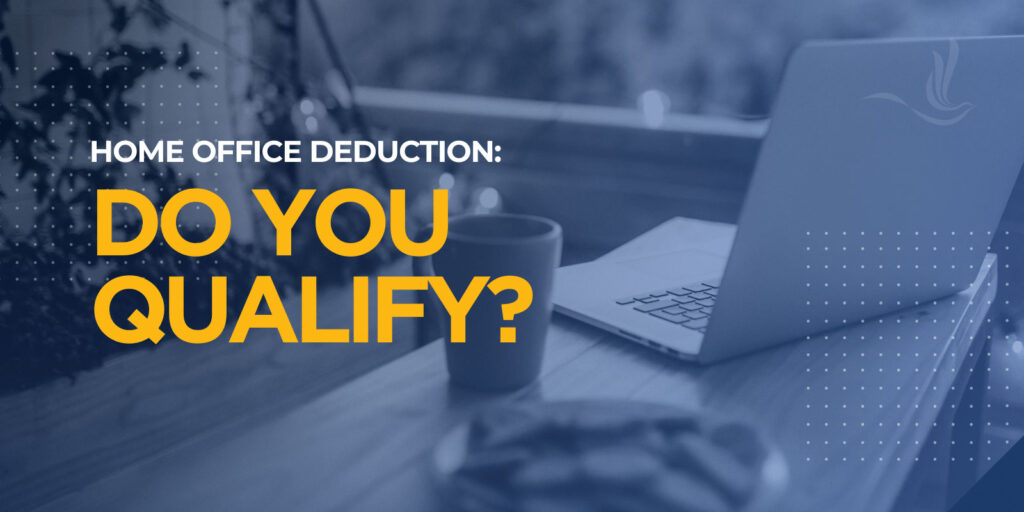

- Business Use Percentage: Determine the percentage of your office space used exclusively for business.

- Home Office Deduction: If you’re a self-employed individual, use the ‘Home Office’ section to enter this information.

- Asset Entry: For capital expenses, enter these in the ‘Assets’ section where you can calculate depreciation over time.

- Office Supplies: Enter expendable items as direct expenses in the ‘Office Supplies’ category.

Step 4: Calculate Your Deduction

TurboTax will help you:

- Calculate the allowable deduction for your office decorations based on the business use percentage.

- If Depreciating: Enter the life of the asset, its cost, and depreciation method (e.g., straight-line) to determine annual deductions.

- Expendable Items: These are directly deductible in the year of purchase, but you should still keep track of the business use percentage.

🧾 Note: For items like furniture, remember to apply Section 179 expensing if applicable to potentially take a full deduction in the year of purchase.

Step 5: Review and File Your Taxes

Before you hit submit:

- Review: Go through all entered data to ensure everything is accurate and complete.

- Document: Attach or store all documentation, as IRS audits can happen, and having everything on hand makes things easier.

- E-file: Consider e-filing your taxes through TurboTax for quicker processing and confirmation.

The process of claiming office decoration deductions on TurboTax involves identifying deductible items, gathering documentation, accurately categorizing within the software, calculating the deduction, and finally reviewing and filing. By following these steps, you can not only improve your office environment but also reap the tax benefits associated with these expenses. Keep in mind that consulting with a tax professional can provide tailored advice, especially for complex scenarios or when in doubt.

As we’ve covered, decorating your office isn’t just about aesthetics; it’s a strategic move for both comfort and tax advantages. By utilizing the functionalities of TurboTax, you can navigate through this process smoothly, ensuring you don’t miss out on any deductions while staying compliant with IRS regulations.

In summary:

- Understand what qualifies as a deductible decoration.

- Keep thorough documentation of all purchases.

- Categorize and enter your expenses correctly in TurboTax.

- Calculate your deductions accurately.

- Review and file your taxes carefully, considering professional advice when necessary.

Navigating tax deductions can be complex, but with a tool like TurboTax, the path becomes clearer. Remember, while TurboTax is designed to help with tax preparation, staying informed about IRS rules and seeking expert guidance when necessary remains crucial for maximizing benefits.

Can I deduct the entire cost of office decorations in one tax year?

+

Yes, for items considered expendable like office supplies, you can typically deduct the entire cost in the year of purchase. However, for capital items like furniture, you might need to spread the deduction over several years through depreciation unless you qualify for Section 179 expensing.

Do I need to keep my home office exclusively for work to claim decoration deductions?

+

Yes, the space must be used exclusively for business to qualify for these deductions. Any personal use could disqualify it from being claimed under the home office deduction.

What if I use the same office for both work and personal activities?

+

If your office space is not used exclusively for work, you can only claim the percentage of the decoration cost that corresponds to the business use of that space. For example, if 50% of the space is for business, you can only deduct 50% of the decorations’ cost.