3 Ways to Categorize Decoration Expenses in Business

When it comes to setting up or maintaining a business space, decoration plays a crucial role in creating an ambiance that reflects your brand identity and enhances the customer experience. However, managing these decoration expenses efficiently can be daunting. Understanding how to categorize these costs correctly not only aids in budget management but also ensures accurate financial reporting for tax purposes. Here are three effective methods to categorize decoration expenses in your business:

Categorization by Purpose

One of the simplest and most straightforward methods to categorize decoration expenses is by their intended purpose. This approach helps in tracking and justifying expenditures to stakeholders or auditors:

- Branding: Costs associated with items that enhance brand visibility, like signage, logos on furnishings, or branded wall art.

- Functional Decor: Expenses for decorations that also serve a functional purpose, e.g., ambient lighting, soundproofing panels, or ergonomic furniture.

- Aesthetic Enhancement: Items purely for the beautification of the space, including paintings, sculptures, and decorative plants.

- Seasonal or Event-Specific: Decorations for holidays, sales events, or special occasions which are often temporary.

📝 Note: Ensure that seasonal or event-specific decorations are well-documented to claim tax deductions accurately.

Categorization by Asset Type

Another approach involves sorting decoration expenses based on the nature of the assets they represent, which can influence depreciation schedules and tax treatments:

| Type of Asset | Description | Depreciation Example |

|---|---|---|

| Furniture and Fixtures | Chairs, tables, shelves, and cabinets. | Depreciated over 7 years using MACRS. |

| Artworks | Paintings, sculptures, or other decor items that could appreciate in value. | Can be appreciated or depreciated based on market trends and IRS guidelines. |

| Soft Furnishings | Curtains, carpets, and cushions. | Typically expensed immediately due to short useful life. |

| Consumables | Floral arrangements, candles, or other short-lived decorative items. | Expensed as incurred. |

Categorization by Cost Allocation

This method involves distributing decoration expenses across different operational or financial aspects of the business:

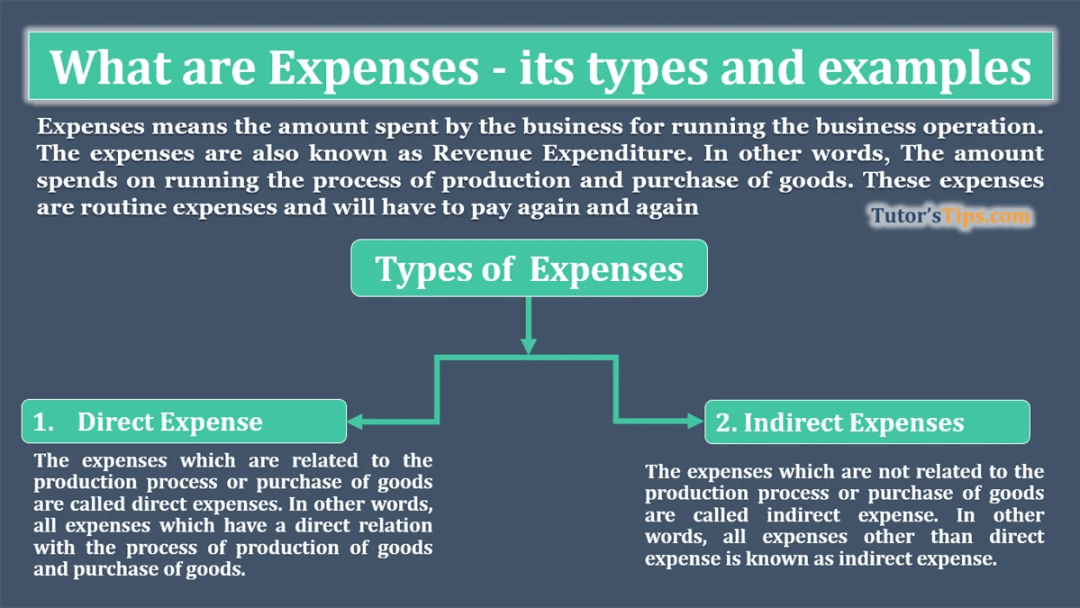

- Direct Costs: Expenses that are directly attributed to specific projects or areas, like a particular event or a themed room.

- Overheads: General decorations that benefit the entire business but aren’t directly associated with generating revenue.

- Capital Expenses: Large purchases that add value to the business over time, such as custom installations or high-end decor items.

- Operating Expenses: Regular, smaller purchases for decoration upkeep or minor additions.

📌 Note: Proper allocation of costs can impact profitability and budgeting forecasts significantly.

In conclusion, by categorizing your decoration expenses using one or a combination of these methods, you can enhance financial transparency, facilitate budgeting, and ensure compliance with tax regulations. Each approach offers unique advantages in managing and justifying expenses related to enhancing the aesthetic appeal of your business space. Understanding the purpose, asset type, and cost allocation for decorations will not only make your financial statements clearer but also provide insights into how effectively decoration contributes to your business's overall success and client experience.

Why should I categorize decoration expenses?

+

Categorizing helps in understanding the impact of these expenses on your business, aids in tax preparation, and can uncover areas for cost savings or better resource allocation.

Can I depreciate all decoration expenses?

+

Not all. Depreciation applies to capital expenses, but operational or consumable decoration costs are usually expensed in the period they’re incurred.

How can I ensure my decoration expenses are tax-deductible?

+

Keep detailed records of purchases, align them with IRS guidelines on business expenses, and ensure they are ordinary and necessary for your business operation.